What is a Cheque?

A cheque is a written document that instructs a bank to pay a specific amount of money from the drawer’s account to a designated person or organisation (the payee). In India, a cheque is part of a cheque book a set of blank cheque leaves issued by the bank. When you sign a cheque and hand it to the payee, the payee can present it to the bank and receive the funds from your account. Cheques help people transfer money without carrying cash and serve as a clear written record of payment.

How Does a Cheque Work?

Drawer Writes and Signs:

- The drawer (the person who owns the bank account) fills in the date, payee name, and the exact amount both in words and figures on a blank cheque leaf.

- The drawer then signs on the designated signature line. The bank will only process the cheque if the signature matches the one on file.

Payee Presents the Cheque:

- The payee (the person or entity receiving payment) can deposit the cheque into their bank account or present it directly to their bank’s teller.

- If the cheque is crossed or marked “Account Payee,” the payee must deposit it into a bank account rather than cashing it over the counter.

Collecting Bank Processes the Cheque:

- The collecting bank (the bank where the payee holds an account) receives the cheque.

- Under India’s Cheque Truncation System (CTS), the collecting bank scans the cheque image and sends the electronic data rather than the physical cheque leaf to the clearinghouse.

Clearinghouse and Drawee Bank:

- The clearinghouse routes the cheque image and details to the drawee bank (the drawer’s bank branch).

- The drawee bank verifies that the drawer has sufficient funds, confirms the signature, and checks for any stop-payment instructions.

Funds Transfer:

- If everything is in order, the drawee bank debits the drawer’s account and sends an electronic confirmation to the clearinghouse.

- The clearinghouse instructs the collecting bank to credit the payee’s account with the specified amount.

- This entire process typically takes 1-2 working days, depending on whether the banks are in the same clearing zone.

Cheque Clearance or Dishonour:

- If the drawee bank finds insufficient funds, a mismatched signature, or a stale/altered cheque, it will dishonour (return) the cheque, and the collecting bank informs the payee.

- The payee then may ask the drawer for an alternate payment method.

Types of Cheques in India

Bearer Cheque:

- No payee name is mentioned, or the word “Bearer” is written instead of a name.

- Whoever holds the cheque can cash it at the bank counter.

- Least secure, since it can be encashed by anyone.

Order Cheque:

- The cheque is made out to a specific person or organisation.

- Only the named payee (or an endorsee if properly signed over) can cash or deposit it.

- More secure than a bearer cheque.

Crossed Cheque:

- Two parallel lines are drawn across the top-left corner of the cheque.

- Can include words like “A/C Payee Only.”

- Indicates that the cheque must be deposited directly into a bank account, not cashed over the counter.

Account Payee Cheque:

- A special form of crossed cheque with “Account Payee” or “A/C Payee Only” written between the lines.

- Ensures the amount is credited only to the payee’s bank account.

- Prevents anyone else from accessing the funds.

Post-Dated Cheque (PDC):

- A cheque dated for a future date.

- Cannot be cashed or deposited until that future date arrives.

- Often used for monthly rent or scheduled payments.

Stale Cheque:

- A cheque presented after its validity has expired (three months from the date on the cheque).

- The bank will usually refuse to honour a stale cheque unless the drawer issues a new cheque or revalidates it.

Self Cheque (Open Cheque):

- Written in the drawer’s favour, to withdraw cash from their own account.

- The drawer signs and presents it to the bank teller like any other cheque.

Traveller’s Cheque:

- Pre-printed in fixed denominations, used mainly when travelling abroad.

- Can be exchanged or encashed at banks outside India.

- Less common today because debit/credit cards and online transfers are widely available.

Cheque Key Terminologies

Drawer:

The person or entity who writes and signs the cheque. Must have sufficient funds in their account.

Drawee Bank:

The bank branch where the drawer maintains the account. Responsible for paying the amount when the cheque is presented.

Payee:

The person or organisation named on the cheque to receive the payment.

MICR Code (Magnetic Ink Character Recognition):

- A 9-digit code printed at the bottom of the cheque in special magnetic ink.

- Facilitates automatic and secure processing in the clearinghouse.

IFSC Code (Indian Financial System Code):

- An 11-character alphanumeric code that uniquely identifies a bank branch in India.

- Used for electronic transfers (NEFT, RTGS, IMPS) and sometimes printed on cheques for reference.

Crossing:

- Drawing two parallel lines (with or without “A/C Payee”) on the cheque.

- Signals that the cheque must be deposited directly into an account.

Endorsement:

- The payee’s signature on the back of an order cheque when transferring it to someone else.

- Transfers the right to encash or deposit the cheque.

Dishonour (Return):

When the drawee bank refuses payment, often due to insufficient funds, signature mismatch, or a stale/altered cheque.

Clearing:

The process of electronic image exchange (CTS) or physical movement of cheques between the collecting and drawee banks for settlement.

Stop Payment:

An instruction from the drawer to their bank to refuse payment if the cheque is lost, stolen, or contains errors. Must be given before the cheque is presented.

Benefits of Cheque

Safety Over Cash:

- Reduces the need to carry large sums of cash, lowering the risk of theft or loss.

- If a cheque is lost, the drawer can instruct the bank to stop payment before it is cashed.

Clear Written Record:

- Every cheque has details such as the date, payee name, amount in words and figures, cheque number, and bank branch.

- Both drawer and payee maintain records (through passbook or account statement) of cheque transactions, aiding in bookkeeping.

Flexible Payment Scheduling:

- Post-dated cheques let individuals schedule payments (for rent or EMI) without needing to be physically present on the payment date.

Widespread Acceptance:

- Many businesses, government departments, and institutions accept cheques for payments.

- Cheques are usable nationwide, even in remote areas where digital connectivity may be limited.

Reduced Physical Currency Handling:

- With cheque usage, banks and organisations handle fewer banknotes and coins, simplifying cash management and reducing costs.

Streamlined Clearing via CTS:

- The Cheque Truncation System cuts down processing time by exchanging electronic images instead of transporting physical cheques, resulting in faster settlement (usually 1-2 days).

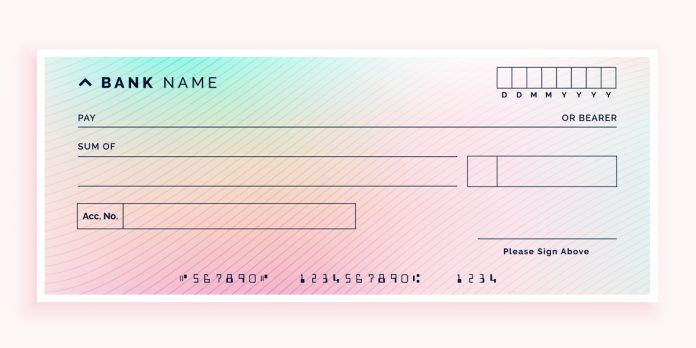

Features of a Cheque

Cheque Number:

- A unique 6 or 7-digit serial printed on each cheque leaf.

- Helps in tracking and referencing payments.

Date of Issue:

- Indicates when the drawer issued the cheque.

- Determines the start of the three-month validity period.

Payee Name:

- Written after “Pay,” e.g., “Pay —-.”

- Ensures payment goes to the intended recipient.

Amount in Words and Figures:

- Amount in Words: Written clearly on the designated line (e.g., “Rupees Ten Thousand Only”).

- Amount in Figures: Written in the box with the ₹ symbol (e.g., “₹10,000.00”).

- If there is a discrepancy, the amount in words is legally binding.

Drawer’s Signature:

- The drawer must sign in the box at the bottom right.

- Signature must exactly match the bank’s record to avoid dishonour.

Drawee Bank Details:

- The bank’s name, branch address, and IFSC code are pre-printed on the cheque.

- Identifies where the drawer’s account is held.

MICR Band:

- A line of numbers in magnetic ink at the bottom, encoding the bank code, branch code, account number, and cheque number.

- Used by machines in the clearinghouse for quick processing.

Security Features:

- Watermarks, fluorescent fibers, or optically variable ink to deter forgery and tampering.

- Banks may include additional anti-fraud elements on cheque leaves.

Crossing Lines:

- Two parallel lines or “A/C Payee Only” to indicate non-transferable payment, ensuring the cheque is credited only to the payee’s account.

How to Fill a Cheque Correctly?

Date the Cheque Properly:

- Use DD/MM/YYYY format (e.g., 05/06/2025).

- Fill the date in neat, legible writing, with no blank spaces that someone could alter.

Write the Payee’s Name Clearly:

- On the line after “Pay,” write the full legal name of the person or organisation.

- Avoid nicknames or abbreviations to prevent confusion.

Fill in the Amount in Words:

- Write the amount in words on the designated line (e.g., “Rupees Ten Thousand Only”).

- Add “Only” after the amount and draw a line to the end of the space, so no one can add extra words or numbers.

Write the Amount in Figures:

- In the box with the ₹ symbol, enter the precise amount in digits (e.g., “10,000.00”).

- Start as close to the left of the box as possible to prevent unauthorised additions.

Cross the Cheque for Security:

- If you want to make it an account-payee cheque, draw two parallel lines at the top-left corner and write “A/C Payee Only” between them (or use the pre-printed crossing).

- This ensures the cheque can only be deposited into the payee’s bank account, reducing misuse if lost.

Sign the Cheque:

- Sign on the signature line at the bottom right.

- Do not sign before filling in other details to prevent someone adding or changing information.

- Make sure your signature matches exactly with the bank’s record.

Avoid Corrections or Overwriting:

- Use a blue or black pen never a pencil.

- If you make a mistake, do not overwrite or use correction fluid. Instead, cancel that cheque and issue a new one.

Check for Legibility and Completeness:

- Ensure all fields (date, payee, amount in words, amount in figures, signature) are filled and easy to read.

- Any smudged or unclear writing may lead to the bank returning the cheque.

How to Cancel a Cheque?

Write “CANCELLED” Boldly:

- Across the face of the cheque, draw lines or write “CANCELLED” in large letters so the cheque cannot be used.

- Ensure you do not sign the cancelled cheque an unsigned cheque cannot be encashed.

Avoid Defacing Important Details:

- Do not scribble over the MICR code or cheque number.

- Simply write “CANCELLED” over the payee and amount areas.

Keep the Cancelled Cheque for Records:

- You may need to submit a cancelled cheque copy when opening new bank accounts or setting up automatic payment mandates.

- Store it safely as part of your documentation.

Issue a Fresh Cheque Leaf:

- If the original had an error, correctly fill out a new cheque.

- Record the new cheque number in your chequebook register to keep track.

Parties Involved in a Cheque Transaction

- Drawer: The individual or entity who writes and signs the cheque. Responsible for ensuring sufficient funds.

- Drawee Bank: The bank branch where the drawer holds their account. Pays the amount to the payee if all conditions are met.

- Payee: The person or organisation named to receive the money. They can deposit or cash the cheque.

- Collecting Bank (Presenting Bank): The bank where the payee deposits or presents the cheque. Sends the cheque information to the clearinghouse.

- Clearing House / Clearing Mechanism: In India, the Cheque Truncation System (CTS) replaces physical movement of cheques with electronic images. The clearinghouse routes the cheque image and data to the drawee bank for verification and payment.

- Endorsee (in Case of Endorsed Cheque): If the payee signs the back of an order cheque to transfer it to another person, that new person becomes the endorsee. The collecting bank verifies the endorsement before crediting funds.

- Reserve Bank of India (RBI): The central banking authority that issues guidelines on cheque clearance, bounce penalties, and stop-payment instructions. Banks and clearinghouses must follow RBI rules.

What is the Validity of a Cheque?

A cheque in India is valid for three months (90 days) from the date written on it. After 90 days, the cheque becomes stale, and banks generally refuse to honour it. Key points to keep in mind:

- Always check the date before handing over a cheque.

- If a cheque becomes stale, the drawer can issue a fresh cheque or, in some cases, revalidate the old one by writing the current date and initialling but not all banks permit revalidation.

- Encourage payees to deposit cheques promptly, ideally within a few days, to avoid rejection due to staleness.

Uses of Cheque

Bill Payments:

- Individuals can use cheques to pay utility bills (electricity, water, telephone), school or college fees, and other monthly charges.

- Many institutions accept post-dated cheques for automatic future payments.

Salary Disbursement:

- Some employers, especially smaller firms, still issue payroll cheques to their employees.

- Provides a clear paper trail for salary payments.

Rent Payments:

- Tenants often give post-dated cheques to landlords to cover rent for several months in advance.

- Landlords deposit the relevant cheque each month, making rent collection easier.

Vendor and Supplier Payments:

- Businesses issue cheques to pay suppliers, creating an audit trail for accounting and tax purposes.

- Crossing the cheque ensures funds go directly into the supplier’s bank account.

Loan Disbursements:

- Banks and NBFCs may disburse personal, home, or business loans via cheque.

- Borrowers can encash or deposit the cheque to receive their loan amount.

Donations and Charitable Contributions:

- Non-profit organisations accept cheques as donations, providing donors with a written receipt for income tax deductions under Section 80G.

Personal Money Transfers:

- Cheques can help individuals transfer large sums of money to relatives or friends without carrying cash.

- The drawer’s and payee’s bank statements each show a clear record of the transaction.

Overdraft and Post-Dated Payment Planning:

- Account holders with an overdraft facility can issue cheques beyond their available balance up to the overdraft limit.

- Post-dated cheques let customers plan payments such as EMIs or recurring bills without missing due dates.

Common Mistakes to Avoid While Using Cheques

- Leaving Blank Spaces: Do not leave any blank lines after writing the payee’s name or the amount. Draw a line or write “Only” to prevent someone from adding extra words or figures.

- Mismatch Between Amount in Words and Figures: Ensure the value written in words matches the figures in the amount box. If there is a difference, the bank honours the amount in words and may return the cheque for clarification.

- Overwriting or Using Correction Fluid: Never use correction fluid or overwrite details. If you make an error, cancel that leaf and write a fresh cheque.

- Unsigned Cheque: A missing signature makes the cheque invalid. Always sign after filling in all details.

- Incorrect Date: Writing a future date by mistake turns the cheque into a post-dated cheque. If the payee tries to deposit it before the date arrives, the bank will return it.

- Not Crossing the Cheque When Intended: If you want the cheque to be deposited only into a bank account, remember to cross it or write “A/C Payee.” An uncrossed cheque can be cashed by anyone who finds it.

- Using Pencil Instead of Pen: Always use a blue or black ink pen. Pencil writing can be erased or altered easily, leading to rejection or misuse.

- Misspelling Payee’s Name: Verify the payee’s name before writing to avoid spelling errors. A misspelt name can delay deposit or cause return.

- Delaying Deposit (Cheque Becoming Stale): Encourage payees to deposit cheques quickly. A cheque that remains unpresented for more than 90 days becomes stale and will be dishonoured.

- Failing to Record Cheque Details: Maintain a cheque register or record each cheque number, date, payee, and amount in your passbook. This helps track which cheques are outstanding and prevents overdrawing your account.